25+ Credit score for mortgage

Anything above 660 is considered to be a good credit score which means that your risk for defaulting on. For a 200000 mortgage at 450 interest In this example with monthly payments of 1112 on a 25-year mortgage of 200000 at 45 APR your total interest paid by.

This Personal Finance Book Will Give You An Excellent Education In Financial Literacy And Teach You H Financial Fitness Personal Finance Personal Finance Books

FHA and VA loans allow borrowers to have credit scores down to 500 FICO.

. In Canada credit scores range from poor around 300 to excellent 900. If your credit score leaves something to be desired it can. The new loan launched this week requires no minimum credit score nor mortgage insurance which lenders typically charge when borrowers put less than 20 down.

A Bank of America storefront. 786 is the median credit score in the US. Minimum credit score to refinance.

620 Highest mortgage rates. Reviewing this large collection of credit reports and credit scores. Enter a 200000 principal on a 30-year fixed-rate loan and.

Prevent you from getting a. Credit scores in the 620-680 range are generally considered fair. These scores are industry-specific and include credit.

Affect your interest rate. Increase your closing costs. Updated Thu Aug 25 2022.

Based on the chart above your 740 credit score and 20 down payment earns a 05 price adjustment. Similar to applying for and managing any other form of credit apply for and managing a mortgage can impact your credit score in different ways. If your credit score is a 625 or higher and you meet other requirements you should not have any problem getting a mortgage.

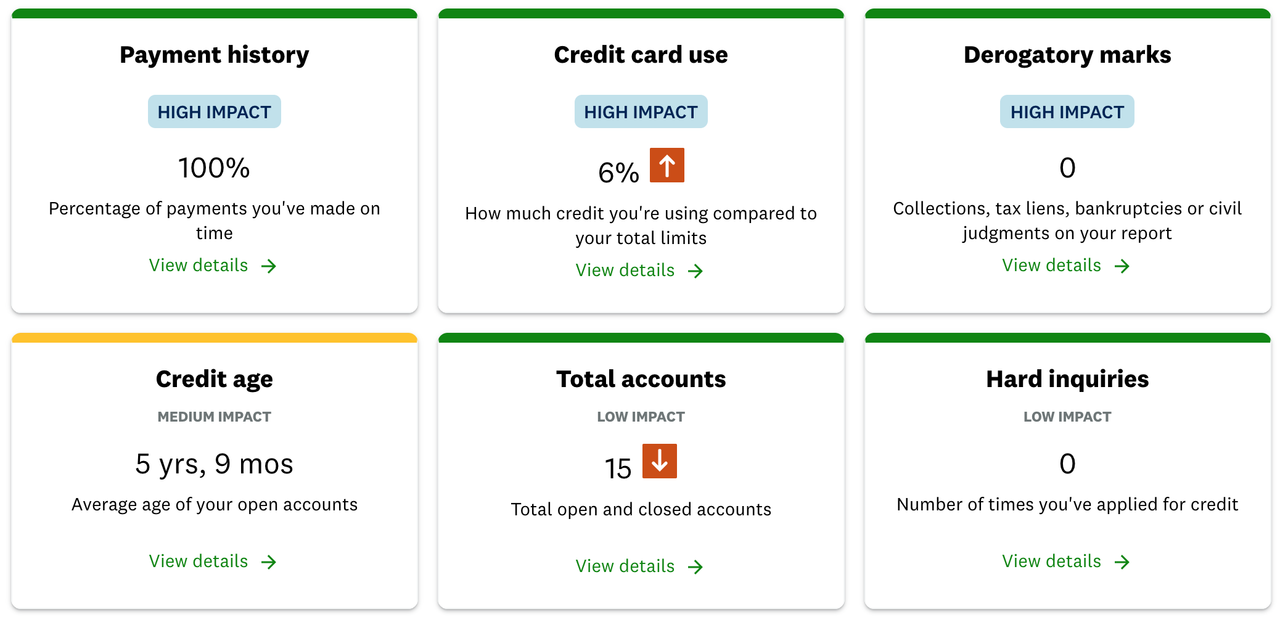

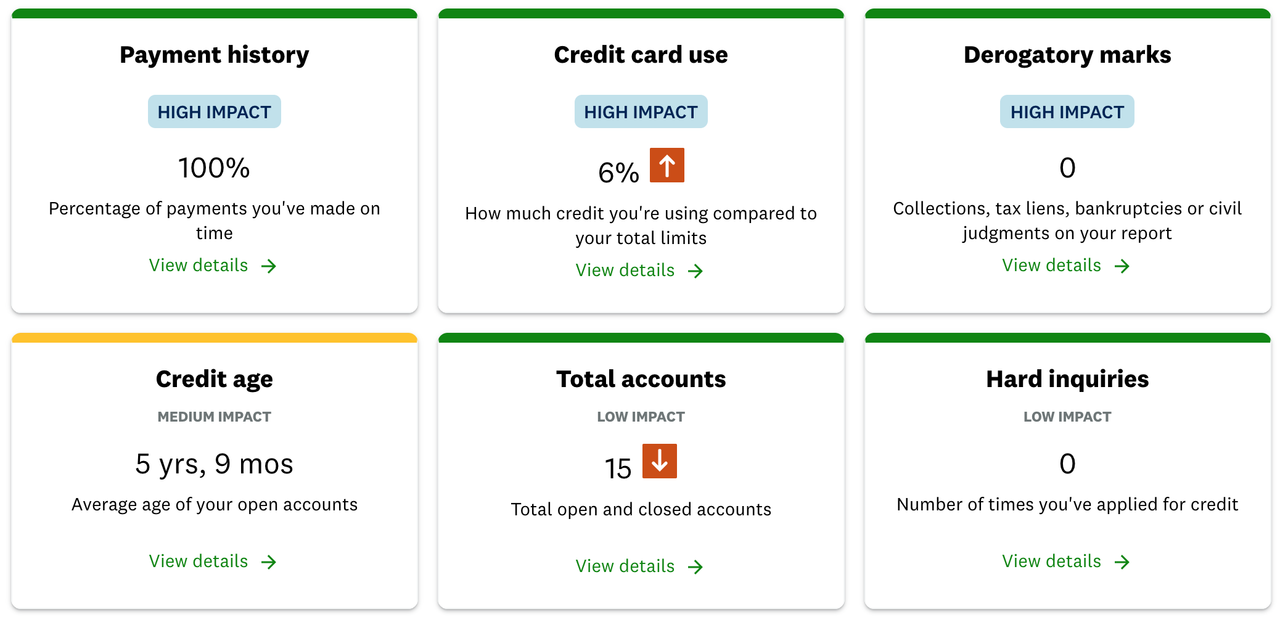

Stay within your credit limits if possible keep balances at 25 or less of your limit as this may help your score. Which credit score is my lender evaluating. Your mortgage lender can give you exact terms after reviewing your complete financial details and down payment.

Minnesota New Hampshire and. Fannie and Freddie Mac generally dont lend to borrowers with scores below 620. If your three FICO scores were 700 709 and 730 the lender would use the 709 as the basis for its decision.

First you can get your credit score free through Canadas two major credit bureaus Equifax and TransUnion which perform a hard credit check and calculate scores from. In this example with monthly payments of 1112 on a 25-year mortgage of 200000 at 45 APR your total interest paid by the end of. Low credit scores often lead to higher interest rates for mortgage applicants.

620 to 720 depending on loan type and lender Conventional mortgages make up the majority of all home loans and are issued by. Most people have multiple credit scores that are changing all the time. The minimum credit score requirement to buy a house depends on the loan program.

For those taking out a mortgage according to Q2 2021 Federal Reserve Bank of New York data. 2 days agoBank of America just launched a zero-down-payment mortgage in 21 cities that could make it much cheaper and easier to buy a home. Improve your credit score for a mortgage application.

Final Monthly Budget Tracker Pdf Edit Pdf Budget Tracker Budgeting Monthly Budget

Pin On Blogging Tips

How To Write A Scholarship Appeal Letter Financial Aid Lettering Letter Example

4 Tips For Choosing The Right Mortgage Lender Programmer Python Python Programming

Channel Partner Partners Channel Supportive

How To Improve Your Credit Age Of Credit History Credit Com

Pin On Family Finance

Personal Loan Minimum Salary 25 Personal Loans Loan Business Loans

At 48yo I Had A Credit Score Of No Credit At 52 I Broke 800 For The First Time R Povertyfinance

How To Get Out Of Debt Fast The Science Backed Way Credit Card Payoff Plan Paying Off Credit Cards Good Credit

1st Florida Lending I No Doc Hard Money Loans

Increasing Credit Score Fast Bogleheads Org

Pin By Rebecca Fisher On House House Alcove Bathtub Bathroom

:max_bytes(150000):strip_icc()/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage

What Comes After A Seller Accepts Your Offer Infographic Real Estate Infographic Real Estate Tips Real Estate Marketing

Pin On Friendly Reminders

At 48yo I Had A Credit Score Of No Credit At 52 I Broke 800 For The First Time R Povertyfinance